When interest rates rise, investors run for cover – and for any good asset they

can find. Alternative investments like real estate investment trusts (REITs) can

be a good option, at least according to the historical data. Let's see how REITs

performed during periods with high and low interest rates.

A Quick REIT Recap

As a result, REITs offer high level of liquidity (a rare quality when dealing with real estate).

The trusts often specialize in specific property types, such as residential apartments,

commercial buildings, warehouses or hotel facilities. REITs are also available in regional variants,

concentrating on real estate in specific countries/regions like the U.S.,

Europe, China or Japan. (For more, see: 5 Types Of REITs And How To Invest In Them.)

REITs offer many benefits, including diversification, the aforementioned liquidity, a small

amount of investment, and tax benefits (depending upon local laws).

REIT Returns Vs. Interest Rates

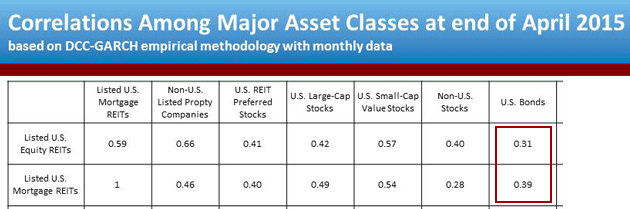

A report from REIT.com shows a historically low level of correlation (how two securities

move in relation to each other) between REITs and the stock market. The same report shows

similar low levels of correlation between REITs and bond yields.

REITs-bonds correlation highlighted.)

Image courtesy REITS.com.

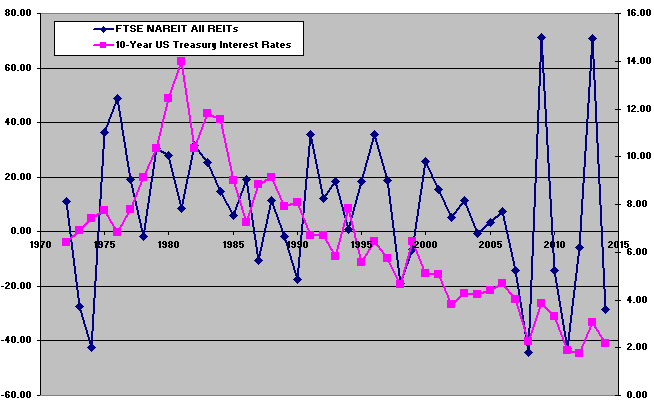

A similar historical comparison between returns

from a popular REIT index and 10-year bond interest rates indicates an inverse relation.

We plot the annual returns of the popular FTSE NAREIT All REITs Index against the interest rates

of 10-year Treasury bonds:

Chart based on REITs index data sourced from REIT.com (left axis) and 10-year Treasury bond data

sourced from stlouisfed.org (right axis).

rising interest rates appear bad for REIT returns and vice versa.

During the high interest rate periods of 1980-1985, the returns

from REITs were lower, while they shot up after 2008 when

interest rates touched record lows. However, there are other

factors and other detailed observations to consider, which may

indicate positive returns for REITs investments even during the

high interest rate era. Drill down into specific time periods

when interest rates were high and interesting observations emerge:

Since 1981, interest rates have been on a downward trend; there were a few sporadic

spikes in the interim years, but overall it has been a consistent decline

(though, as of October 2018, they have begun inching up again). for interest rates.

With each passing five- or 10-year period, a lower range of interest rates was considered “high.”

The return from REITs were also in the high range of 9% - 32%.

1991-1997: This period saw a new range of high interest rates,

which varied from 6% - 8%. The return from the REIT Index was

in the range of 12% - 36%, with the exception of 1% during 1994.

which varied from 6% - 8%. The return from the REIT Index was

in the range of 12% - 36%, with the exception of 1% during 1994.

2000-2001: The next high interest range was during 2000-2001 period,

when rates hovered around 5.5%. Returns from REITs ranged from 16% to 26%.

7.4% (compared to high range of 10% to 14% the following years). REITs

performed badly with annual losses in the range of -42% to -27%.

when rates hovered around 5.5%. Returns from REITs ranged from 16% to 26%.

How did the REITs rates fare during the interim low-interest periods?

1973-1974: Interest rates were comparatively lower, ranging from 6.9% to 7.4% (compared to high range of 10% to 14% the following years). REITs

performed badly with annual losses in the range of -42% to -27%.

1998-1999: The interest rates were in range of 4% - 5.5%, and the returns

from REITs were still negative to the tune of -18% to -6%.

from REITs were still negative to the tune of -18% to -6%.

2007-2012: As interest rates dipped progressively from 4% to less than 2%,

REITs earned consistent yearly losses in the range of -45% to -5%, with only

one exception of positive returns in 2009.

REITs earned consistent yearly losses in the range of -45% to -5%, with only

one exception of positive returns in 2009.

These observations indicate that REITs may not really have any dependency on interest rates scenarios.

The returns from REIT investments may actually remain free from interest rate variations.

REIT Benefits to Investors

There are other benefits of REITs, which make them a good investment choice even during high

interest periods:

Income Opportunity: REITs are considered yield-based securities. While they can

avoid having to pay corporate tax if they distribute at least 90% of their income to their

unit holders. This tax break results in a regular distribution of dividend income to REIT

shareholders, and the effective net yields are often higher than the ones from bonds

(or stocks), even in cases of high interest rates.

Global Diversification: REITs offer exposure to global markets. Since the 1990s,

the U.K., Singapore, Japan, Australia, the Netherlands, South Africa and many others

countries have enabled REIT listings, allowing investors to take exposure in real estate

markets of foreign nations. For example, if the local real estate market in the U.S. tanks

due to effects of higher interest rates, a U.S. investor with exposure to the Singapore

real estate market can benefit if he holds REITs in Singapore real estate in his portfolio.

Sector Specific Exposure: In the event of rising interest rates, not all the sub-sectors

within real estate may get hit adversely. For example, residential rents may suffer, but

shopping centers in prime locations may not. Careful study of the real estate market, the

impacts of interest rates on a specific sub-sector, and on specific REITs based on its underlying

property holding, can make REIT investment profitable no matter the interest rate impact.

Residential, Healthcare And Office REITs.)

The Bottom Line

After looking at correlation patterns and historical data, it appears that returns from

REITs remain independent of interest rate periods. After careful study and proper

selection of real-estate sub-sectors and geographic regions, investors can consider

REITs a good alternative to the traditional stocks and bonds, which are highly sensitive

to interest rates.

https://www.investopedia.com/articles/investing/091615/are-reits-beneficial-during-highinterest-era.asp

No comments:

Post a Comment